Online Filing of Nebraska Fuel Tax Returns

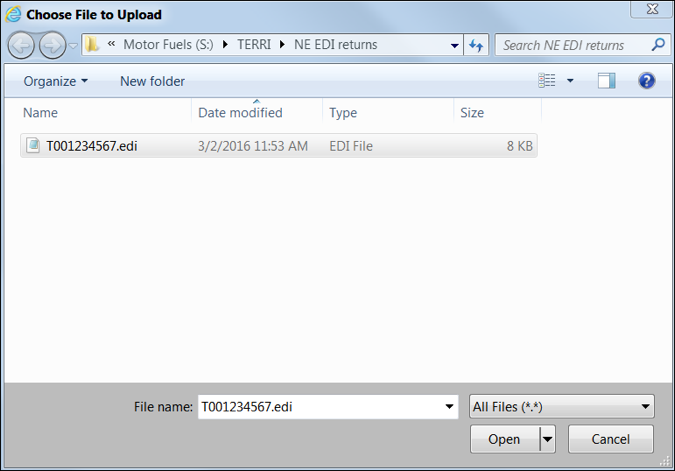

After selecting the "Upload File" button, locate the file on your computer or other electronic device. To locate the file, select the "Browse" button on the "Fuel Tax Form Submission" page. You will receive a pop-up screen similar to the one shown below. Search for the folder to which you saved the Nebraska EDI file created by your EDI software program. Once found, click on the file; the file name will appear in the box after "File name." Select the "Open" (Add, or Submit) button on the pop-up screen.

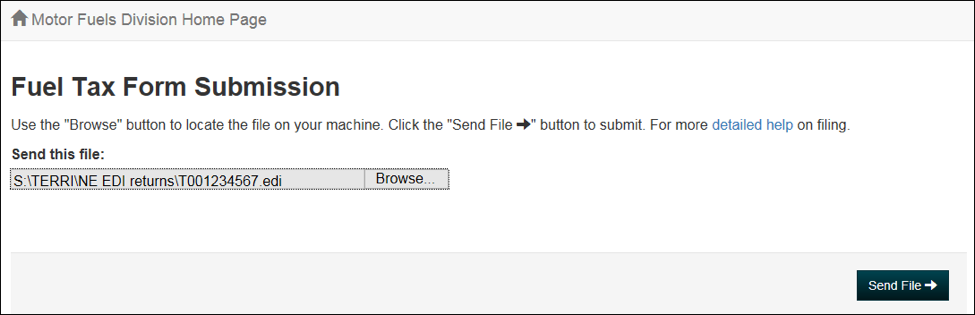

After selecting "Open," you will return to the "‘Fuel Tax Form Submission" page. It will list the location path of the EDI file on your operating device.

To insure proper filing of your return, the file name must consist of the appropriate letter and your Nebraska identification number. For example, the January return for a company with a Nebraska identification number of 1234567 would be A001234567.edi. The "A" designates the month being filed is January. "001234567" is the Nebraska identification number, followed by the ".edi" extension. Additional information regarding the naming convention is found below.

Once you have selected the appropriate EDI file, select the "Send File" button as shown below.

Shortly after submitting the file, you will receive an acknowledgement showing the date and time of your submission. Please retain the acknowledgment in your records as proof of submission.

Naming Nebraska EDI Files

As appearing in the EDI Implementation Guide

Naming Files

A naming convention has been developed for returns and reports transmitted through Nebraska.gov. Naming the files before they are transmitted will aid in processing the files through the provider and also through the Motor Fuels Division's system.

All files must have a 10-character alpha-numeric filename and .edi or .EDI extension.

The 10-character name for your file will consist of one alpha character representing the tax month being filed, and nine numeric characters representing the taxpayer's Nebraska ID number.

The month indicators are:

| Month | Original | Amended |

|---|---|---|

| January | A | M |

| February | B | N |

| March | C | O |

| April | D | P |

| May | E | Q |

| June | F | R |

| July | G | S |

| August | H | T |

| September | I | U |

| October | J | V |

| November | K | W |

| December | L | X |

| Test | T | |

Examples

- A000072759.EDI is the January return for the taxpayer assigned Nebraska ID number 000072759

- B006259285.EDI is the February return for the taxpayer assigned Nebraska ID number 006259285

- Anytime a test file is transmitted, a "T" should be used instead of a month indicator